transfer car loan to another person australia

Based on your risk profile. There are two primary ways to transfer a car loan to another individual.

Car Loans For Teens What You Need To Know Credit Karma

Another option open to car buyers who would like to transfer the agreement to another but cannot do so is to settle the existing debt and take out a new agreement in the other persons name.

. If you want to transfer a car loan to another person you also have to transfer ownership. The next step is to modify the title of the car to reflect its new owner unless some deal was worked out beforehand where the original loan holder retains ownership. Eligibility criteria for car loan balance transfer.

The eligibility criteria for transferring your auto loan balance may vary from lender to lender. Find a suitable buyer or check with car dealerships. Based on your risk profile.

A or B multiplied by the number of unexpired whole months in the term at the time this contract is paid out divided by. Borrow between 2001 and 75000 to finance a new or used car up to 7 years. You need to ensure that your motor insurance policy is also transferred in the name of the car buyer.

The most common criteria include. Youll receive a fixed rate from 525 pa. In order to get the best price from a dealer make sure you get it appraised by at least three dealerships and make sure that one of them sells the same make as your vehicle.

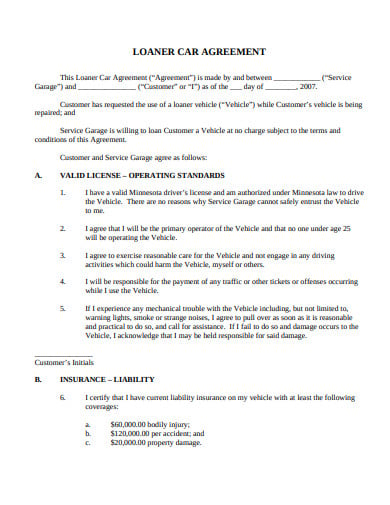

25 of the original loan amount if 12000 or less. You cannot transfer a car loan contract from one person to another. Youll want to fill out your end of the paperwork in advance so that you can guide your buyer through the loan transfer process.

The amount of the fee is. After the refinance loan is signed by your transfer partner the loan has successfully been transferred to a different name. Instead a vehicle can be transferred to a nominee a person who is nominated to act on behalf of another person until the minor reaches eligible age.

This means you can rest easy about not having to make payments on a car you no longer own. Make sure that you have transferred vehicle ownership to the new borrower. The new buyer will likely need to visit your lender in person so that your lender can witness signatures and set up direct deposit.

Make sure you identify a buyerborrower with a good credit standing. Initiate registration and insurance transfer only if your bank has consented to the transfer. How does Transfercar work.

Modify with your existing lender or seek a new lender. Purchase a new or used. A car loan contract exists between you and the creditor.

The Short and Sad of It. Transferring a Car Loan to Another Person. First seek out the approval of your bank to transfer the loan before you venture into the loan transfer process.

Again talk to your finance company. Seeking a new lender will end up costing you more but the new borrower will likely see. Transferring personal loans.

If the new borrower can qualify for the car loan the lender may agree to transfer the. Prior to opting for a Car Loan transfer make sure you attain consent from your bank. You should be 60 years or lesser at the end of your loan tenure.

Many other options exist to get out from under a car loan. 750 if the original loan amount exceeds 12000. A car loan can represent a huge monthly expense for young couples that can put them in a real financial bind.

Youll receive a fixed interest rate from 535 pa. A personalised loan from 2001. Let them know your intentions and ask for the help in facilitating the process.

Modifying with your existing lender will present the least penalties to you but it may not be the best deal for the new borrower. Once the Statutory Declaration Deceased Estates Form MR172 PDF file has been filled in take it to a Driver and Vehicle Services Centre or regional agent or regional agent with the current licence papers. A transfer fee must be paid.

Personal loans also known as installment loans or consumer loans cant be transferred to another person. They can either use expensive trucks or they can let you relocate their rental cars and campervans for free. The short answer which you are not going to like.

Check with the RTO and insurance provider only after you have got consent from your lender that the transfer is. However the person to whom you want to transfer the loan must be approved by your. These authorities will then undertake a background verification with your lender before changing the car registration details.

If the individual is below the minimum eligible age you cannot transfer a vehicle into their name. It is somewhat easier to transfer a car loan to another person either with the same lender or a new one. By law the person who signed an auto loan is the owner of the car.

When the registration and title are transferred to a new owner the lender needs to be notified. 16 years for light vehicles and trailers. Submit all the related documents updated loan.

Thereafter you must request the RTO authorities to transfer the car in the name of new owner. To transfer vehicle ownership you need to get a declaration from the executor or administrator of the estate. Rental car companies are spending large amounts of money on relocating cars between their branches in order to position their fleet for new hires.

If you have sold are or trying to sell your car to someone else you may be able to transfer your loan to the buyer as well. 18 years for a motorcycle or heavy vehicle. Transfer the motor insurance policy.

Unfortunately most lenders wont allow a personal loan to be transferred. While you could refinance your car into someone elses name there are easier ways to get rid. Put together the necessary documents.

You should be at least 21 years old at the time of applying for the loan. If theres enough equity in your car you can trade it in pay off your existing loan and use the remainder as a down payment on another vehicle. First you will have to submit the bank documents showing the details of new borrower to the RTO office.

The rental operators win you win. You should do this to ensure that you dont have to pay insurance premium anymore once the car registration and the loan are transferred to another person. OurMoneyMarket Personal Loan Fixed 1 - 7 Years 2001 - 75000Exclusive.

If you took out a personal loan you were given the cash up front an interest rate and loan terms based on your credit score. Every time someone is added or removed from a car loan the title changes to reflect this.

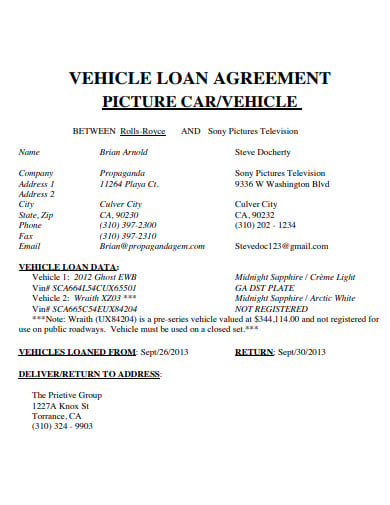

How To Make A Car Loan Agreement Form Samples 5 Samples

Nri Car Loan In India Eligibility Interest Rates Sbnri

Can I Use My Car As Collateral For A Loan Bankrate

How To Make Your Car Payment Yourmechanic Advice

How To Finance A Car At 0 Interest Nerdwallet

3 Car Loan Agreement Templates In Google Docs Word Pages Pdf Free Premium Templates

Average Auto Loan Payments What To Expect Bankrate

Car Loan Apply Auto Loan Online At Low Interest Rate Bank Of Baroda

How Old Do You Have To Be To Buy A Car Experian

3 Car Loan Agreement Templates In Google Docs Word Pages Pdf Free Premium Templates

How To Make A Car Loan Agreement Form Samples 5 Samples

Can A Car Loan Keep You From Getting A Mortgage Real Estate News Insights Realtor Com

How To Get A Car Loan In Bankruptcy After Bankrate Com

What Is A Good Credit Score To Buy A Car

How Do I Qualify For A Car Loan Experian

What S The Average Car Loan Length Credit Karma

How To Make A Car Loan Agreement Form Samples 5 Samples

Using A Car As Collateral For A Loan Self Inc

Why Are 72 Month And 84 Month Auto Loans A Bad Idea U S News