does td ameritrade report to irs

TDAmeritrade says IRS wants to tax the Schedule K1 in IRA unrelated business taxable income. My TD Ameritrade Tax Statement shows.

Schwab Td Ameritrade Merger Impact On Existing Td Ameritrade Individual 401k Solo 401k Account Holders My Solo 401k Financial

Can I enter K1 in turbotax and click the IRA for the K1 to do the taxes.

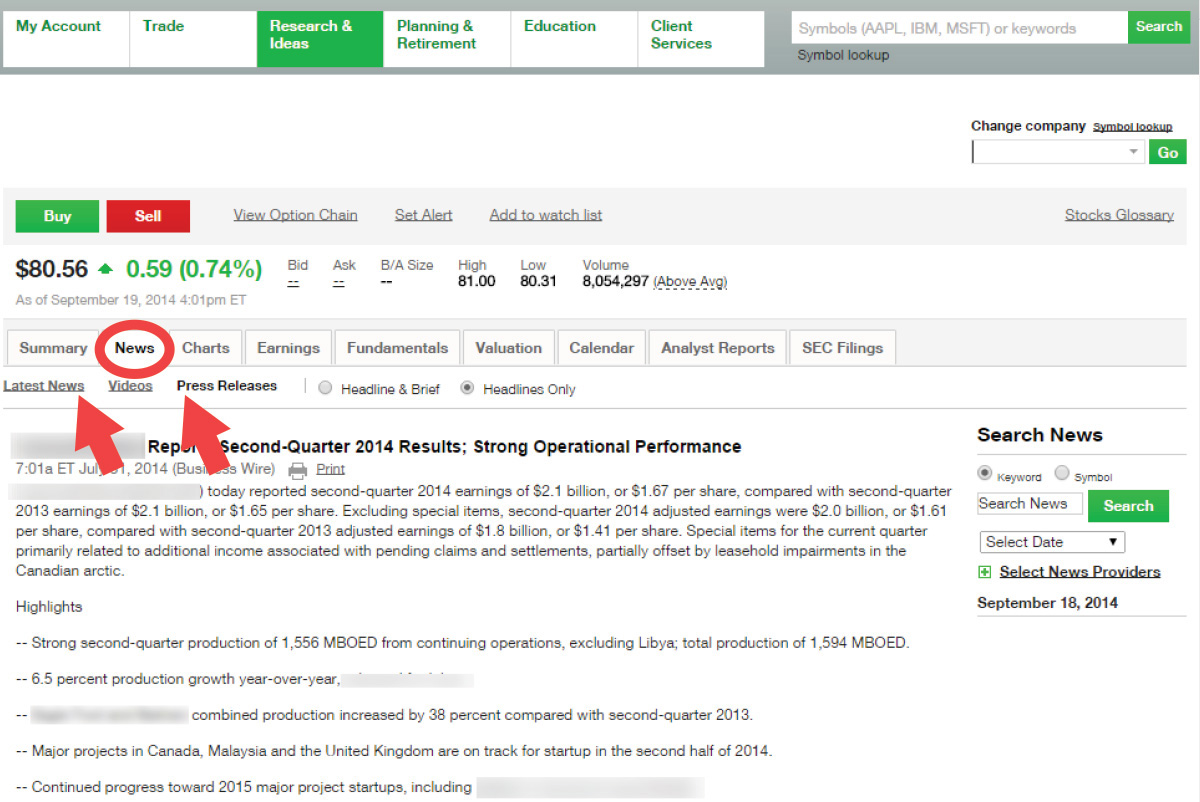

. Intraday data is delayed at least 20 minutes. Steps to access your T5 through online banking. Under the Documents listing locate your T5.

TD Ameritrade does not report this income to the IRS. Have you talked to a tax professional about this. TD Ameritrade hosts an OFX server from which your 1099-B realized gain and loss information may be retrieved by our program.

Have you talked to a tax professional about this. TD Ameritrade does not report this income to the IRS. 3 Supplemental Summary Page A snapshot of the additional information that TD.

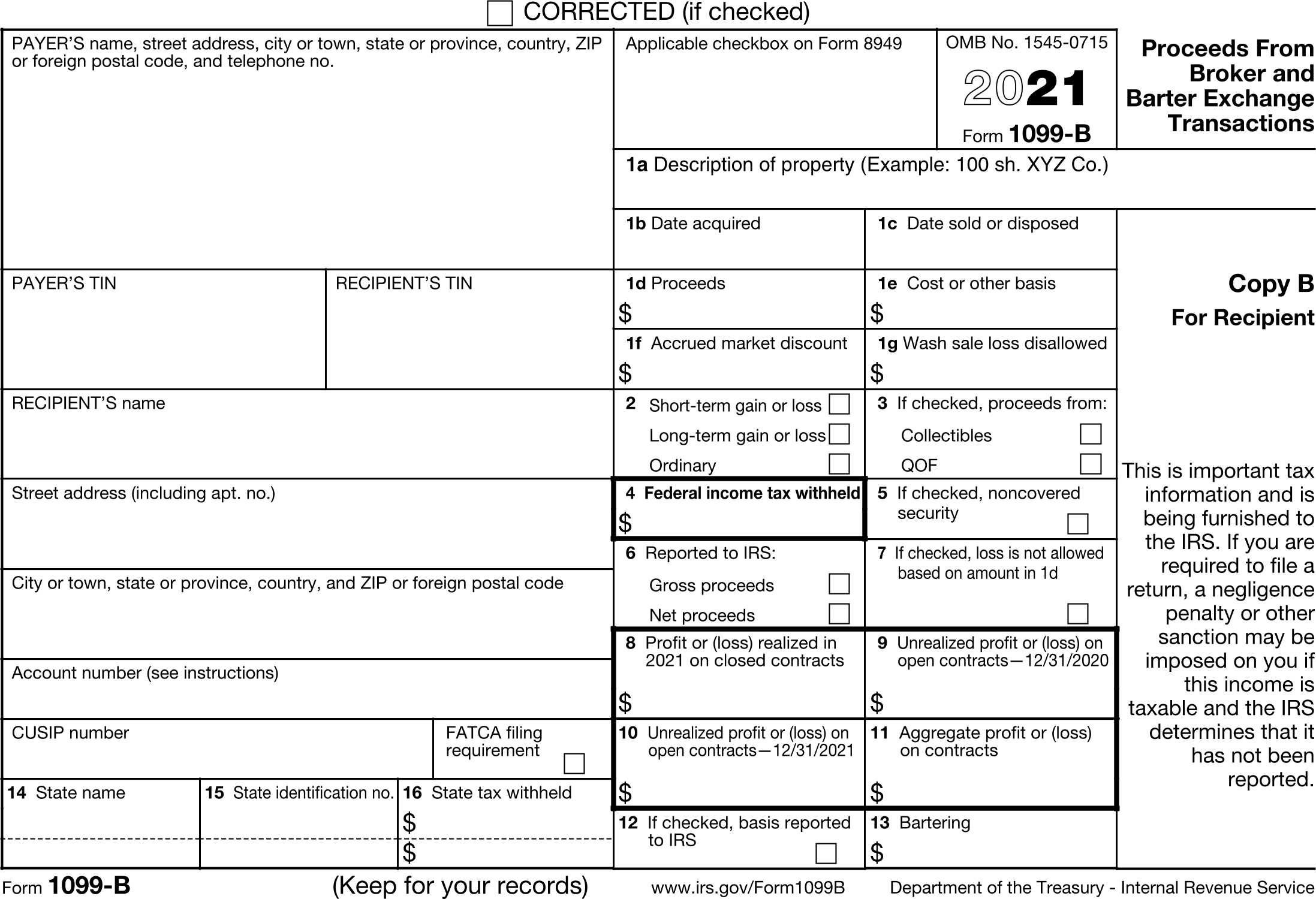

A Consolidated 1099 Form which. Anything else you want the. TD AMERITRADE uses the following forms to report income and securities transactions to the IRS.

Document ID Number What does TD Ameritrade report to IRS-----The most important part of our job is creating informational content. TD Ameritrade does not provide tax advice. You pay tax on it if you profit income tax rate if short term capital gains.

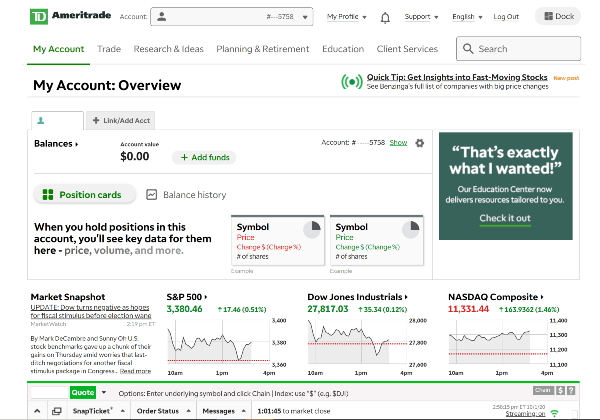

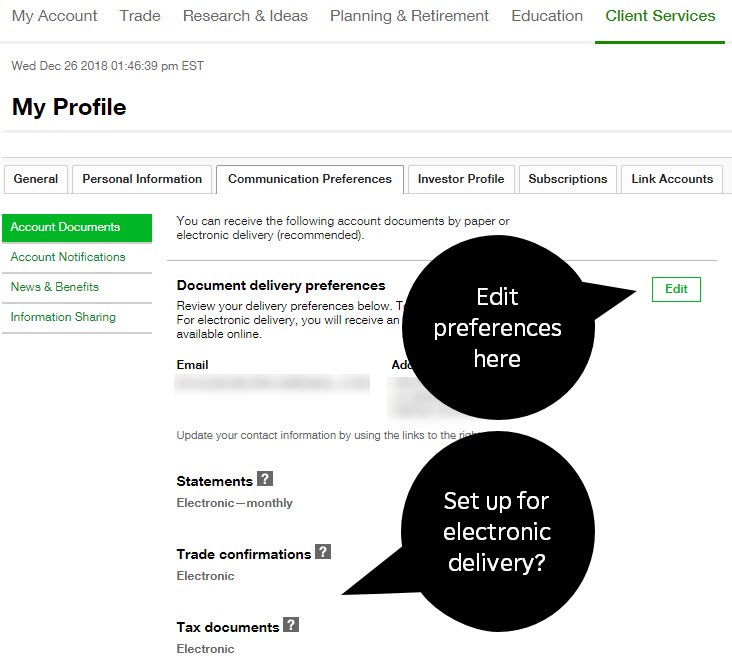

WKFS and is made available by TD Ameritrade for general reference. Under the My Accounts list in the left hand column click View e-Documents. Understanding Form 1040.

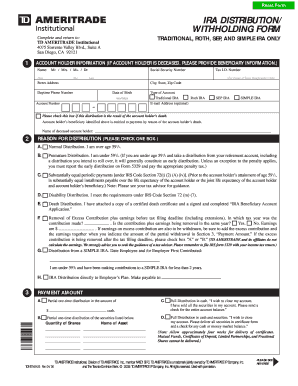

TD Ameritrade will not report cost basis information on tax-exempt accounts to the IRS. The custodian bank is charged with safeguarding your financial assets to report required information to the IRS eg 1099s etc and provide you statements of your holdings. Does Ameritrade report to the IRS.

If you have any questions please contact your Advisor or call TD Ameritrade Institutional at 800-431-3500. Form 1099 OID - Original Issue Discount. The topic of this.

TD Ameritrade was evaluated. Its hard to figure the rule that TD. Under the Documents listing locate your T5.

GainsKeeper service and performance reporting is offered and conducted by Wolters Kluwer Financial Services Inc. If you hold covered securities with tax-exempt original issue discount OID it will now be reported to the IRS on Form 1099-OID. To retrieve information from their server you will.

What does TD AMERITRADE report to the IRS. Posted on March 10 2017 by admin. We suggest you consult with a tax-planning professional with regard to your personal circumstances.

Individual Tax Return Form 1040 needs to be filed with the IRS by April 15 in most years.

Follow Up Post Last Week I Made A Post About What Td Ameritrade Sent Me In Regards To My Shares Being Non Covered Today I Took Action And Filed Complaints With The Sec

Equities Hold Stocks Bonds Mutual Funds In A Self Directed Ira

How To Open A Td Ameritrade Account Outside Of The Us As A Non Resident Alien Katie Scarlett Needs Money

Td Ameritrade Says I Made 196k In 3 Months R Tax

1040s 1099s Other Federal Tax Forms What You Mig Ticker Tape

Transferring Stock From Computershare To Td Ameritrade

Our Td Ameritrade Review How To Get Started Pros Cons And More Navexa

How To Read Your Brokerage 1099 Tax Form Youtube

Td Ameritrade Forms Fill Out And Sign Printable Pdf Template Signnow

Go Paperless This Tax Season Electronic Tax Forms Fr Ticker Tape

Td Ameritrade Internal Transfer Form Fill Online Printable Fillable Blank Pdffiller

The Fine Print Of Earnings Reports Ticker Tape

Td Ameritrade Review A Robust Investing Platform

Td Ameritrade Says I Made 196k In 3 Months R Tax

1099 Information Guide Td Ameritrade 1099 Information Guide Td Ameritrade Pdf Pdf4pro

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate

Report Stock Sales On Taxes Easily How To Report Capital Gains Youtube